san francisco gross receipts tax apportionment

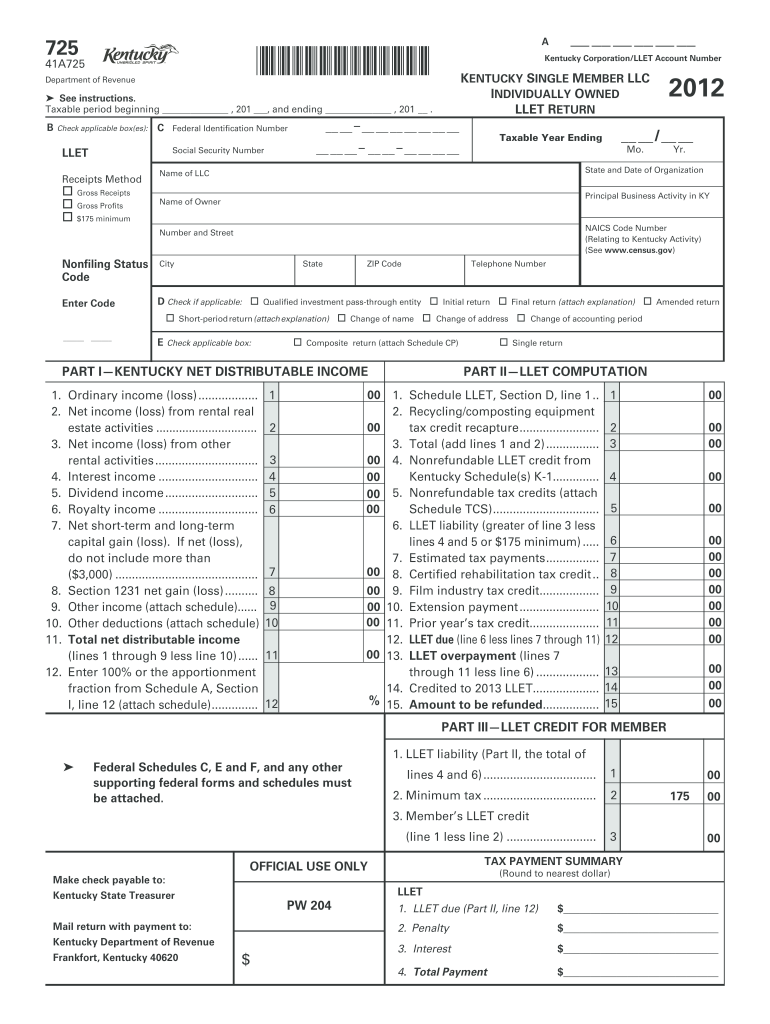

For the 2020 tax year non-exempt. Trust And Estate Administration.

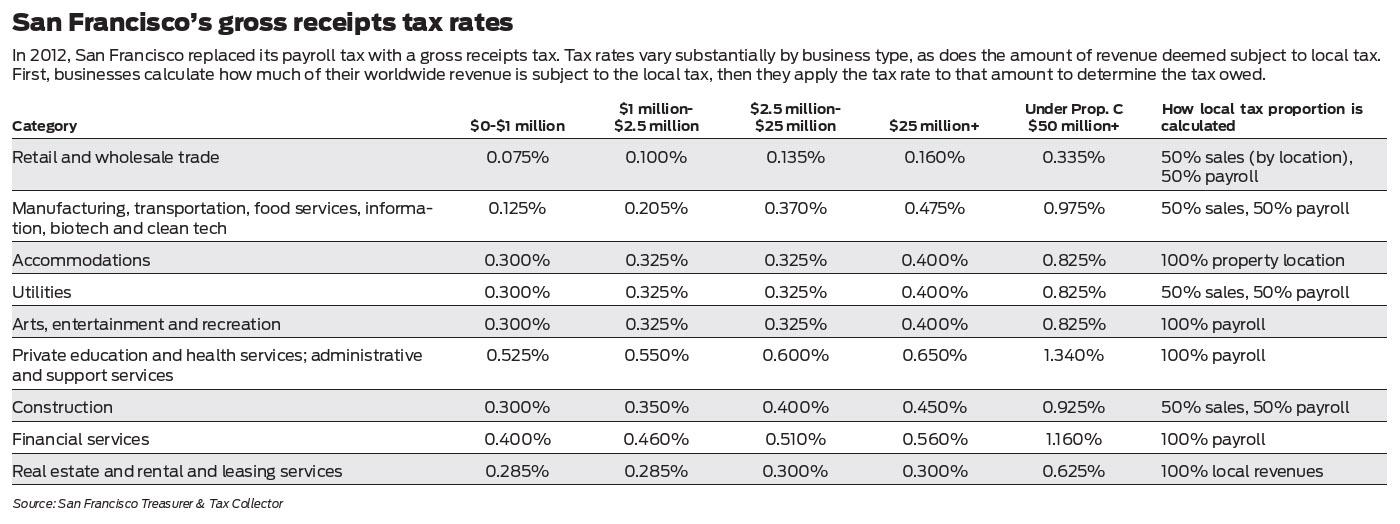

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went.

. APPORTIONMENT OF RECEIPTS BASED ON PAYROLL. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section. 29 Gross Receipts Tax Ordinance 960 and 961.

Reporting requirements and computation. San Francisco Gross Receipts Tax B14. And Miscellaneous Business Activities.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business. On November 6 San Francisco voters approved Measure E which imposes a gross receipts tax on persons engaged in business activities in San Francisco. Gross Receipts Tax Applicable to Private Education and Health Services.

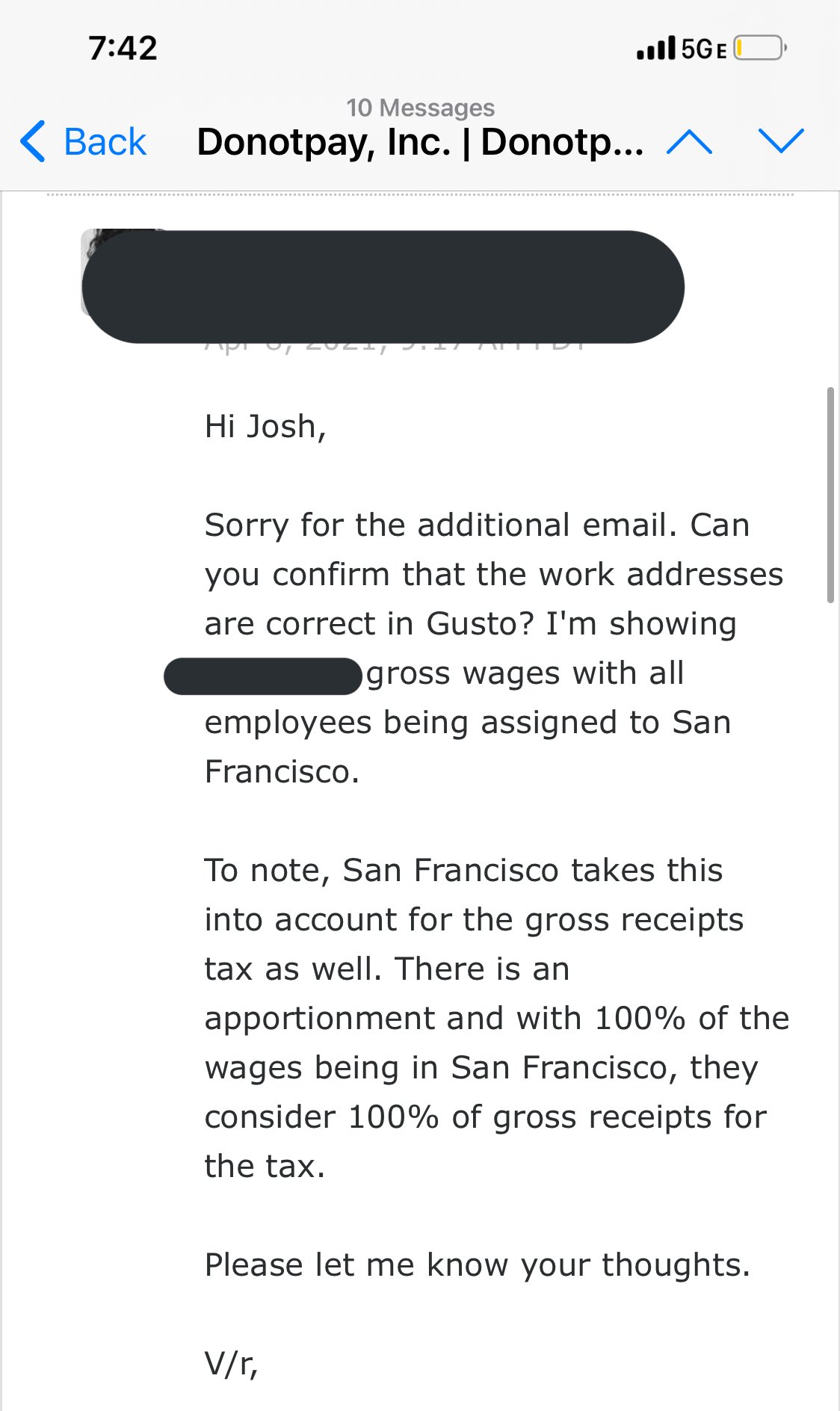

A For all persons required to. While San Franciscos gross receipts tax went into effect beginning January 1 2014 confusion continues to linger regarding two aspects of the tax. Taxpayers deriving gross receipts from business activities both within and outside San Francisco must allocate andor apportion gross receipts to San.

April 28 2016. BUSINESS AND TAX REGULATIONS CODE. You ARE ENCOURAGED to file if your 2020 payroll expense was less than.

Payroll Expense Tax. San Francisco Business and Tax Regulations Code. Receipts from the sale of real property for which the Real Property Transfer Tax was paid B15.

All persons deriving gross receipts from business activities both within and outside the City shall allocate andor apportion their gross receipts to the City using the rules set forth in Section. San Francisco Gross Receipts Tax B14. Administrative and Support Services.

28 Gross Receipts Tax Ordinance 9541b. The purpose of this article is to provide a general overview of San Franciscos sourcing rules and their application to specific industries. 27 Gross Receipts Tax Ordinance 9541a.

Therefore when you register for a San Francisco. Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll. Business Activities NAICS Codes.

San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit. 1 The measure will. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

26 Gross Receipts Tax Ordinance 9523e. Confusion with San Franciscos gross receipts tax centers on two aspects of the tax. San francisco gross receipts tax apportionment In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop.

The citys gross receipts tax which remains a stealth payroll tax for most companies will become especially confounding as remote work grows. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. In this Insight we we look at nexus the NAICS code.

Receipts from the sale of real property for which the Real Property Transfer Tax was paid B15.

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

Ending Confusion Over San Francisco S Gross Receipts Tax Silicon Valley Business Journal

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

San Francisco Passes Proposition C To Increase Gross Receipts Tax On Commercial Landlords Coblentz Law

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

Texas Comptroller Revisions Dallas Business Income Tax Services

States Latest Weapon In The Struggle For Tax Revenue Gross Receipts Taxes Accounting Today

![]()

Getting To The Core Of Gross Receipts Taxes Salt Shaker

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Gross Receipts Tax Category Archives Seesalt Blog Published By State Local Tax Attorneys Pillsbury Winthrop Shaw Pittman Llp

Income Franchise Gross Receipts Tax Bdo Tax

Getting To The Core Of Gross Receipts Taxes Salt Shaker

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

San Francisco Taxes Filings Due February 28 2022 Pwc

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Joshua Browder On Twitter Just Heard Back From The San Francisco Tax Office According To Them They Consider 100 Of Your Revenue To Be In San Francisco For The New Gross Receipts

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us